- Home

- About Us

- Abroad Study

- Why Study Abroad

- Study Abroad Country

- Our Services

- Career Counseling for Study Abroad

- Examinations Guidance for Overseas Education

- Profiling for study abroad

- International University Selection

- Guidance in Documentation and Application Submission for Study Abroad

- Statement of Purpose(SOP) Guidance

- Interview Preparation for Study Abroad

- International Scholarship Search

- Accommodation Assistance while Studying Abroad

- Abroad Educational Loan Assistance

- International Student Visa Assistance

- Travel/Insurance Assistance while Studying Abroad

- Foreign Exchange Assistance

- Pre-departure Orientation for study abroad

- Study Abroad Tests

- International Scholarship

- UK Scholarships for International students

- Canada Scholarships for International students

- USA Scholarships for International students

- New Zealand Scholarships for International students

- Australian Scholarships for International students

- Singapore Scholarships for International students

- Ireland Scholarships for International students

- Scholarship in France for International students

- Scholarship in the Netherlands for International students

- Business Management

- What is business management consulting

- Our Services

- Generation of Business Ideas

- Initial Idea Screening

- Market Research

- SWOT Analysis

- PESTEL Analysis

- Porter’s Five Forces Analysis

- Franchise Opportunities

- Business Planning

- Portfolio Optimization

- Sourcing Strategy

- Inventory Management

- Supply Chain Solution

- Customer Relationship Management (CRM)

- Pricing Policy

- Marketing/Advertisement Guidance

- Import Export

- The importance of Import and Export

- Our Services

- Establishing Export-Import Business

- Obtaining Importer Exporter Code (IEC) from the DGFT

- Registration with different Export Promotion Councils (EPC)

- International Market Research

- Export Documentation

- Pricing Strategy in International Marketing

- Searching Buyers/Sellers Internationally

- Important Links for Import and Export

- List of Export Promotion Councils and Commodity Boards in India

- News

- Career

- Payment

- Blog

- Contact Us

-

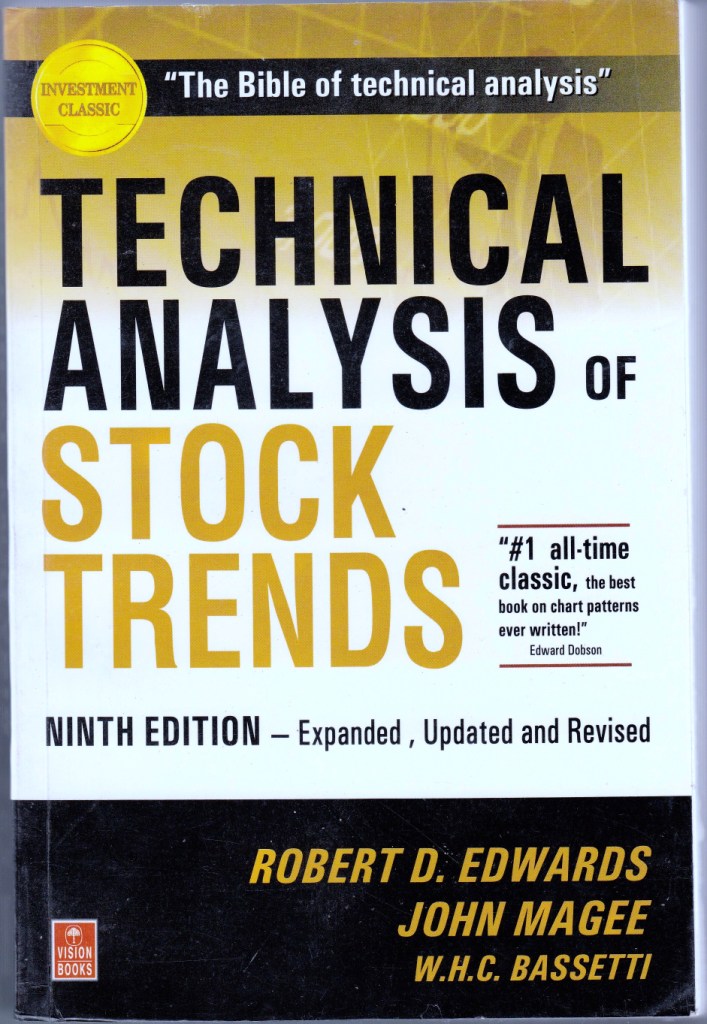

Technical Analysis of Stock Trends

MRP 795, Discount 10% (Shipping Charges Extra)

Details

TECHNICAL ANALYSIS OF STOCK TRENDS

Title- Technical Analysis of Stock Trends

Author- Robert D. Edwards, John Magee, W.H.C. Bassetti

Publisher- Vision Books Pvt Ltd.

Category- Miscellaneous

Language- English

Edition- 9th Edition,

ISBN 10- 81-7094-742-1

ISBN 13- 978-81-7094-742-4

Total Numbered Pages- 790

Binding- Paperback

Condition- Used

Contents

Preface to the Ninth Edition

Preface to the Eighth Edition

In Memoriam

Preface to the Previous Edition

Part 1: Technical Theory

Chapter 1 The Technical Approach to Trading and Investing

Chapter 2 Charts

Chapter 3 The Dow Theory

Chapter 4 The Dow Theory in Practice

Chapter 5 The Dow Theory’s Defects

Chapter 5.1 The Dow Theory in the 20th and 21st Centuries

Chapter 6 Important Reversal Patterns

Chapter 7 Important Reversal Patterns — Continued

Chapter 8 Important Reversal Patterns — The Triangles

Chapter 9 Important Reversal Patterns — Continued

Chapter 10 Other Reversal Phenomena

Chapter 10.1 Short-term Phenomena of Potential Importance

Chapter 11 Consolidation Formations

Chapter 12 Gaps

Chapter 13 Support and Resistance

Chapter 14 Trendlines and Channels

Chapter 15 Major Trendlines

Chapter 15.1 Trading the Averages in the 21st Century

Chapter 16 Technical Analysis of Commodity Charts

Chapter 16.1 Technical Analysis of Commodity Charts, Part 2

Chapter 17 Summary and Some Concluding Comments

Chapter 17.1 Technical Analysis and Technology in the 21st Century: The Computer and the Internet, Tools of the Investment/Information Revolution

Chapter 17.2 Advancements in Investment Technology

Part 2: Trading Tactics

Midword

Chapter 18 The Tactical Problem

Chapter 18.1 Strategies and Tactics for the Long-term Investor

Chapter 19 The All-Important Details

Chapter 20 The Kind of Stocks We Want — The Speculator’s Viewpoint

Chapter 20.1 The Kind of Stocks We Want — The Long-term Investor’s Viewpoint

Chapter 21 Selection of Stocks to Chart

Chapter 22 Selection of Stocks to Chart — Continued

Chapter 23 Choosing and Managing High-risk Stocks: Tulip Stocks, Internet Sector, and Speculative Frenzies

Chapter 24 The Probable Moves of Your Stocks

Chapter 25 Two Touchy Questions

Chapter 26 Round Lots or Odd Lots?

Chapter 27 Stop Orders

Chapter 28 What Is a Bottom — What Is a Top?

Chapter 28.1 Basing Point Case Analysed,Illustrated

Chapter 29 Trendlines in Action

Chapter 30 Use of Support and Resistance

Chapter 31 Not All in One Basket

Chapter 32 Measuring Implications in Technical Chart Patterns

Chapter 33 Tactical Review of Chart Action

Chapter 34 A Quick Summation of Tactical Methods

Chapter 35 Effect of Technical Trading on Market Action

Chapter 36 Automated Trendline: The Moving Average

Chapter 37 “The Same Old Patterns”

Chapter 38 Balanced and Diversified

Chapter 39 Trial and Error

Chapter 40 How Much Capital to Use in Trading

Chapter 41 Application of Capital in Practice

Chapter 42 Portfolio Risk Management

Chapter 43 Stick to Your GunsBusiness Management

-

Executive Summary

Rs.2,500.00

-

Executive Summary

Rs.2,500.00

-

Executive Summary

Rs.2,500.00

-

Executive Summary

Rs.2,500.00

-

Executive Summary

Rs.2,500.00

-

Executive Summary

Rs.2,500.00

-

Executive Summary

Rs.2,500.00

-

Executive Summary

Rs.2,500.00

-

Executive Summary

Rs.2,500.00

-

Executive Summary

Rs.2,500.00

-

Executive Summary

Rs.2,500.00

-

Executive Summary

Rs.2,500.00

-

Executive Summary

Rs.2,500.00

-

Executive Summary

Rs.2,500.00

-

Executive Summary

Rs.2,500.00